WHAT PAYROLL ITEMS ARE EXCLUDED BY THE INSURANCE COMPANY AS THEY CALCULATE HOW MUCH TO CHARGE FOR A POLICY?

- Chris Cain, CWCP

- Dec 17, 2024

- 3 min read

Updated: Jul 21, 2025

There are many factors insurance companies consider and exclude when calculating how much a business owner pays for a workers' compensation insurance policy.

One of the factors in determining the cost is payroll. The Insurance Underwriter will use payroll and multiply it by the employee's classification code.

This is why it is so important to spend time making sure you have the correct class code for each employee!

G L O S S A R Y | Workers' Compensation Insurance Policies

INSURANCE PREMIUMS: The amount of money you pay each month or year to keep your insurance policy active.

INSURANCE AGENT: A person who helps businesses or individuals obtain insurance policies, advises on insurance coverages, etc., and completes requirements to submit paperwork to underwriters. The agent is the 'middle-man' between the employer and the underwriter/carrier.

INSURANCE UNDERWRITER: Works for the insurance carrier and evaluates an insurance application received from an insurance agent. The underwriter decides whether to approve or deny an application request for insurance based on the guidelines from the insurance carrier they work for. Underwriters also determine coverage amounts and premiums. The underwriter is the 'middle-man' between the insurance agent and the insurance carrier.

INSURANCE CARRIER: Often called the insurance company. They receive the payments for an insurance policy. In the event of a claim, they will pay according to the terms agreed upon in the policy.

PREMIUM DEVELOPMENT: The multitude of factors that determine how much you will pay for a policy.

CLASSIFICATION CODE | CLASS CODE: A number system that insurance companies use to associate an employee's potential risk/danger they are exposed to. Approximately 800 different codes are used to determine insurance costs per employee. Using the wrong code can make your insurance premiums higher. Some codes can also be used as specific exclusions in a policy. Using the proper class code is extremely important.

PAYROLL: Money a business must pay its employees, such as wages, overtime, vacation, bonuses, sick leave, commissions, profit sharing, etc. Insurance Companies will use past, present, and projected payroll information in many different ways.

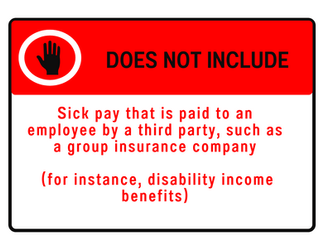

Insurance carriers typically

exclude certain payroll items

(called Premium Development Exclusions)

as they calculate how much

These payroll exclusions are:

Meticulous bookkeeping is important when it comes to payroll. Ironically, when an insurance claims adjuster settles indemnity claims, an injured employee's total wages are used, including ALL overtime wages. The opposite happens in premium development where it is excluded. So, understandably, payroll can get confusing in all the different aspects of insurance. We will discuss indemnity claims in an upcoming blog.

The primary discomfort for many businesses of a Workers' Compensation policy is how expensive the premium can become. However, understanding what is excluded in payroll calculations -- and then how payroll is calculated with the classification codes -- perhaps can reduce some costs and eliminate mysteries.

If you have questions on payroll, talk to your insurance agent before it becomes a problem. Your agent is there to help you. If you are looking for a new agent, give us a call and see how we are different.

Classification Codes

Perhaps the most vital aspect in the computation of premium

is the PROPER classification code of the type of labor performed by workers.

Look for our upcoming blog on how Class Codes are a major factor in premium development.

ABOUT CHRIS

Current

Host of Work Comp Chaos | licensed in multiple states as both an insurance adjuster & agent

Vice President of The Southern Agency Insurance in charge of Operations and Claims

United Heartland Insurance Company Claims Advisory Council

Speaking Events

Altaworld Insurance Tech & Innovation Conference: Fireside Chat The Role of Automation in Claims Processing - Reducing Fraud or Reducing Jobs?

Stairbuilders & Manufacturers Association: Hidden Liabilities

Georgia Public School Board Workers' Compensation Association: How To Handle Work Comp Claims

Homebuilders of Atlanta: Claims and Warranties

Lunch & Learn: Various Uses of Life Insurance - Key Man, Tax-Free Benefits, Buy-Sell Agreements

Prior

State of Tennessee Telehealth Advisory Committee assisting in developing rules and statutes

Utilization Review Advisory Committee

Past President of the Tennessee State Claims Association

Served 15 years as President of the Chattanooga Claims Association

Comments